Despite the fact that there were record Q3 American Silver Eagle sales by the US mint, bankers have still been able to suppress spot and paper silver prices, creating enormous premiums of 34% for current year BU silver eagles and up to an astonishing 51% or more for BU silver eagles just a few years old (source: Apmex.com).

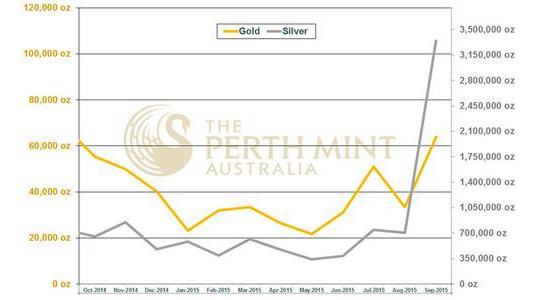

The US mint is not the only global mint reporting record physical demand. The Perth Mint, as evident in the chart below, also reported exploding demand for gold and silver coins and bullion for this past September.

However, as long as spot gold and spot silver prices are based on a fake, banker-manipulated paper market, gold and silver prices will continue to languish in the immediate term, and the spread and premiums between real physical gold and physical silver and fake paper gold and faker paper silver prices will continue to grow.

We have seen loads of articles that state that silver coins are not a good buy because they trade at such a significant premium over spot silver prices. This is a load of rubbish. Spot silver prices are tied to paper silver and if you want to buy physical silver of any kind at this time, you are going to need to pay a significant “premium” over paper silver prices. In the end, we look at the price of physical silver as simply the price for real physical silver and the prices of spot silver as the price for fake paper silver if you prefer fake paper silver over the real deal!