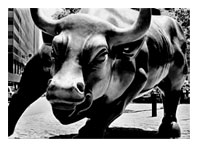

March 11, 2007 – I’m sure you know of people that are perpetual bulls. These are the people that no matter what the situation in the global markets are always telling you that things are positive. Perpetual bulls tend to inhabit certain positions — Chief investment advisors at global firms, editors at investment newsletters, and so on. Why?

Because it is their job to get you to buy their services (aka “hand your money over to them”) and positivity sells a lot better than negativity, even if it is deceit-filled positivity. I know some people will say “but don’t you advocate buying stocks, or at least establishing partial positions of certain stocks, on major corrections?” and the answer is yes. However, this is vastly different than being a perpetual bull and saying buy anything in the Chinese markets, buy anything on the Hang Seng, buy anything in the Dow because you should ride the bull! This is what perpetual bulls do. They will tell you to buy when markets have risen dangerously high without corrections so that you ride them through the corrections. Then after you’ve lost a lot of money in the markets as a result of the correction, they’ll tell you “buy more!” because it’s a fantastic buying opportunity!

Because it is their job to get you to buy their services (aka “hand your money over to them”) and positivity sells a lot better than negativity, even if it is deceit-filled positivity. I know some people will say “but don’t you advocate buying stocks, or at least establishing partial positions of certain stocks, on major corrections?” and the answer is yes. However, this is vastly different than being a perpetual bull and saying buy anything in the Chinese markets, buy anything on the Hang Seng, buy anything in the Dow because you should ride the bull! This is what perpetual bulls do. They will tell you to buy when markets have risen dangerously high without corrections so that you ride them through the corrections. Then after you’ve lost a lot of money in the markets as a result of the correction, they’ll tell you “buy more!” because it’s a fantastic buying opportunity!

However, it can only be a REAL buying opportunity if you had not bought in to the market yet because you were aware that a strong correction was likely or if you were so far ahead of the game that now stocks that were up 100% before the correction are now only up 80%. It is NOT a buying opportunity if you just lost 10% to 15% in a stock, and the perpetual bulls want you to buy more of these stocks that are sitting on losses because they convinced you to buy when you should have been protecting profits instead or not entering new positions in the market at all.

Furthermore, beware the perpetual bull because he or she consistently manipulates statistics in a deceitful manner to convince you that you need to invest in the markets now and that you need to hand over you money to them now.

For example, towards the end of last year as U.S., Chinese and Indian markets rose higher every day, I saw many investment newsletters tout the Indian Sensex level of 14,000, and the exuberance of U.S. markets and Chinese markets as a reason every investor should pile into these markets and not miss out on historic runs. In fact, one email forwarded to me included a prediction of 14,000 for the Dow in 2007. I wonder what this same newsletter is saying now? In any event here is what this email stated in December of 2006.

“The Dow Jones industrial index closed at a new record high yesterday. And apparently, traders don’t think that this is all there is. This morning, before the markets opened, Dow industrial futures had run up 43 points to 12,552.

Irrational exuberance? Well, exuberance maybe, given the record earnings posted by companies, but if you ask me, nothing can be more rational than riding a bull market as it powers higher.

The U.S. Labor Department supplemented the optimism by indicating that the Consumer Price Index for November remained unchanged. Core CPI, excluding food and energy prices, was also unchanged.

If we’re seeing pops in the markets like yesterday, I think we may be in for a heck of a January Effect. I’d not be surprised to see the Dow knocking loudly at the 13,000 mark in early January. If this barrier would be broken, I don’t see any hindrance for the bull to go “hyper-bull,” heading toward 14,000 in 2007.”

In November, 2006, this is what I was saying in the Underground Investor blog: “Recently, headlines about record recent highs in the U.S. Dow, the India Sensex, and the U.K. FTSE have dominated financial headlines. However, 99% of these articles never explore the new index numbers in the proper perspective. Just as I have mentioned in numerous previous blogs that paying attention to the U.S. Consumer Price Index as a proxy for real inflation or the Consumer Confidence Index as a proxy for true economic strength is dubious at best, so are the reports about all these record global markets.” The reason I made these comments back then is that on an absolute number basis, many record highs are in reality nowhere close to record highs. The major indexes of country specific stock markets are not inflation adjusted.

If they were, then you would realize that for example, the U.S. Dow Jones Industrial Average index must clear the barrier of 14,000 on an inflation adjusted basis just to get an investor back to even from a starting point six years ago. When viewed in terms of real purchasing power instead of meaningless numbers, then even 13,000 is a level not to get excited about, and even 14,000 does not signify the midst of a great bull market. What Dow 14,000 means is that your money just recovered the purchasing power it had if you had invested in the Dow six years ago.

But it’s hardly surprising that the perpetual bulls supplement their arguments by citing statistics of even a greater dubious distinction like the Consumer Price Index (just conduct a search here on our blog for “Consumer Price Index” to understand why this particular economic indicator should hold no value whatsoever in your stock buying and selling decisions). In any event, advice that you read contrary to the perpetual bulls is often written by those not looking to cherry pick dubious economic indicators and present dubious interpretations to sell subscriptions or seeking to gather more assets.

That is the difference between learning how to build wealth versus chasing wealth. Listen to the perpetual bulls and you will forever be chasing wealth. Seek out the minority positions by those that actually take the time to dig down the rabbit hole to seek out the facts behind the propaganda, and you will build wealth.

So am I saying, to use the U.S. markets as one example, that the Dow will now not hit 13,000 this year? It may and it may not. However, the more important point to take away from this discussion is that there are a lot of economic conditions in all countries that represent reality that are never disseminated to the general public. Even in the face of the corrections, U.S. Secretary of Treasury Hank Paulson was already ensuring that his comments about the good health of the U.S. economy were spread far and wide by the mass media.

However, his statements belie the fact that there are still many highly negative conditions in the U.S. economy that lurk well below the horizon of the average investor’s sightline. Even if this recovery demonstrates that it has legs, these negative conditions will eventually bubble to the surface and blindside the same group that always is blinded by the perpetual bulls. This is the greatest reason to beware the perpetual bulls. Follow them and you’ll never build wealth.

[tags]wealth literacy, investment myths,consumer price index, politics and stocks, China, India, peak investment crisis[/tags]