Real financial journalism is dead. Financial journalism has been dead for decades, but in the most recent decade, it has taken a particularly rapid turn for the worse. I have been writing articles for years about the transition of mainstream financial media into a mouthpiece for Central Bankers and the State as a primary reason why the public’s understanding of reality when it comes to financial topics is so underdeveloped and poor. With advertising and money driving journalism decisions, much of industry journalism, including financial journalism, has degenerated into sensationalistic headlines and shoddy reporting, geared more towards generating clicks and advertising revenue rather than towards actually rooting out truth. Due to this industry wide shift, on more occasions than not, sensationalism dominates mainstream financial media reporting to the point whereby financial stories only fall into two categories: (1) repeated narratives of Central Bankers and the State that are often untrue, with no investigative reporting every occurring to ferret out the truth; and (2) sensationalistic stories that are 99 parts speculation and hype and 1 part fact.

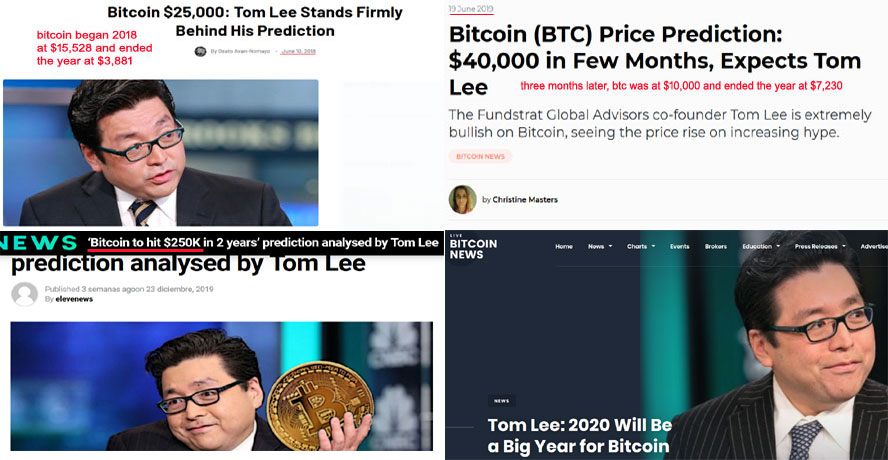

As an example of the shoddy nature of mainstream financial journalism, look at the four photos below of annual bitcoin predictions by Fundstrat’s Tom Lee in recent years that illustrate not only incorrect predictions, but absurdly and grossly incorrect predictions, all spread by mainstream financial media sites like Reuters, Bloomberg, CNBC, etc.

When Tom Lee predicted $25,000 bitcoin prices in 2018 after the year started out with a bitcoin price of more than $15,500, he doubled down in June, even after BTC prices had plummeted to $6,500 by restating that bitcoin prices would close the year at $25,000. Bitcoin prices fell to $3,880 by the end of 2018. In 2019, perhaps Tom Lee felt as if his prior year BTC price prediction missing the mark by more than $21,000 was not enough, so to start the year, he stated that BTC would end 2019 at a price between $20,000 and $64,000. Later, in June of 2019, emboldened by BTC’s price rise to $8,400 in early June, Fundstrat’s Tom Lee doubled down on his prediction at mid-year, much as he had done the prior year, and revised his prediction to state that BTC would rise to $40,000 in a “few months”. A few month’s later, BTC rose to $10,000 but ended the year just a couple hundred dollars above $7,000, about $13,000 less than his low end-year prediction of $20,000, $57,000 less than his high end-year prediction of $64,000 and nearly $30,000 less than his mid-year prediction of $40,000. Furthermore, regarding Tim Draper’s BTC prediction of $250,000 by 2021, though Mr. Lee did not endorse the time frame of Draper’s prediction, he stated that when BTC price graphs are viewed from a logarithmic basis, that a $250,000 price is reasonable. No person of sane mind would consider such promotion of patently bad predictions year after year as upholding any type of integrity in journalism standards, and as such, mainstream financial journalism deserves to be called “dead.”

In nearly every other arena of news, except one in which a certain narrative is targeted by the banking-State-military industrial complex for promotion, someone that had been so absurdly wrong in multiple, consecutive price targets for an asset would never be interviewed again, let alone be provided a platform on the largest financial media channels with a reach of millions of people worldwide. But yet again, Tom Lee’s predictions for 2020 have been plastered all over mainstream financial media channels. And even if he is correct one year, if you keep to the same absurd narrative year after year after year, perhaps one year, by default, he will be correct. But bitcoin is not the only asset in which financial media actors, pretending to be “journalists” when in reality they are just presenters that pose as journalists, grant a massive platform to people that have been absurdly wrong every year in their predictions. We must be intelligent enough to understand that this does not happen by mistake, but that it is a deliberately executed strategy by those in charge of media distribution. It seems that the more the journalism industry descends into the realm of the insane and absurd, the more financial “journalists” tend to promote absurdly erroneous predictions and narratives every year, while never granting any access to their platform with massive reach to anyone that actually correctly predicted BTC’s collapse from $20,000 at the start of 2018 to less than $5,000 that same year. If you don’t know the identity of the handful of people that made such accurate predictions, and then followed up these accurate predictions about BTC prices in 2018 with fairly accurate predictions about BTC’s price behavior last year, ignorance of the names of these people merely solidifies my point. You are much more likely NOT to know their identities, due to a mainstream financial media blackout of accuracy in reporting in finance.

Regarding the sector of precious metals, mainstream financial media journalists have also relentlessly supported equally absurd predictions year after year. In 2013, self-proclaimed “futurist” Harry Dent predicted gold prices would crash to $700 an ounce, and when this never materialized, he stated that he was only one year early and that gold prices would crash to $700 in 2014. When this failed to materialize again, to start 2015, Dent stated that $700 gold was a “certainty” in 2015 and 2016, and when this “certainty” didn’t happen, he predicted $700 gold in 2017, and when this didn’t happen, Dent predicted $700 gold would happen in 2018. As Google has a tendency to erase all foolish predictions of State narratives that are revealed as sponsored propaganda with the benefit of hindsight, I often take screenshots of financial website headlines that I know will never come true, and then after they disappear and are shadowbanned from Google’s search algorithms, I will discuss them later, with proof that these ridiculous predictions were supported by the mainstream financial media, and proof that Google wiped such articles from the search algorithms years later.

Today, many still fail to understand that Google is not a purveyor of truth and that their algorithms actively censor many people that speak power to truth. In fact, in this interview in 2017, Harry Dent stated that he didn’t believe that his $700 gold price prediction was low enough, and predicted that gold prices would crater from his original absurd $700 price prediction to an insanely absurd prediction of $400 to $450 an ounce (see the linked video at the end of this article). By the way, gold prices respectively ended 2013, 2014, 2015, 2016, 2017 and 2018 at $1,204, $1,206, $1,060, $1,150, $1,291 and $1,279, with high gold prices during these years often being close to twice, or more than twice as high as Dent’s gold price prediction for the majority of the year. Unlike with Fundstrat’s Tom Lee, whose predictions may have a chance of finally being correct in the future, I don’t believe that Harry Dent will ever be correct by sticking with his annual Central Banker-inspired gold price crash narrative. Harry Dent, if he predicts gold price crashes to $700 or $400 an ounce in the future again, will be worse than a broken clock, because at least a broken clock tells the right time twice a day, whereas Dent will never be correct. But yet, the absurd nature of Dent’s incorrect predictions, as has been the case with Fundstrat’s Tom Lee, has never prevented mainstream media channels from welcoming Harry Dent back to their media channels to present his “futurist” predictions about gold every year.

Hopefully, the absurdity of what passes for financial “journalism” in mainstream media distribution channels these ideas will prevent you from ever following mainstream financial media as your “news” sources upon which you base future investment decisions. If you wish to make intelligent investment decisions in the future and avoid the coming collapse of the bubble of everything, you must start seeking out independent financial media, such as this blog, and others of a similar nature, whose mission is to uncover truth and not to maximize clicks and revenue. http://maalamalama.com/wordpressThe Parasitic Warfare Between the Banking Class and Humanity, as Explained by the Brilliant Film, Parasite

Other recent skwealthacademy posts:

Sneak Peek into 2019 Patron Only Content, including Past Gold and Silver Price Predictions

The Parasitic Warfare Between the Banking Class and Humanity, as Discussed in the Film, Parasite

No Bank Account is Truly Risk Free